EQUITA advised VEGA CARBURANTI

The Esso-branded distribution network in Italy has been taken over by a consortium of private Italian operators, marking the return to national ownership of a strategic asset for the energy and mobility sector.

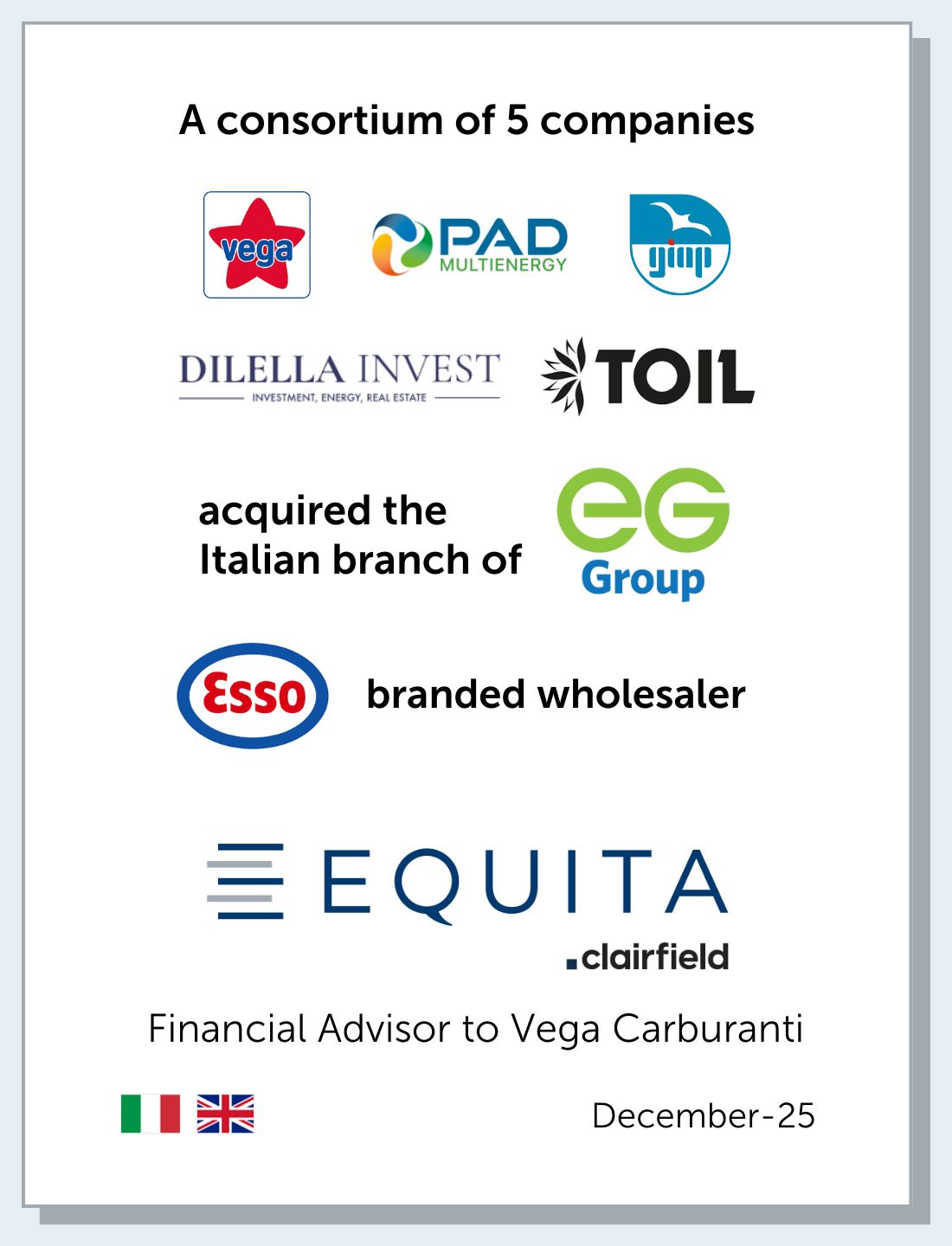

EG Italia (Esso branded wholesaler), a subsidiary of the British EG Group, has been sold to a consortium comprising Pad Multienergy, Vega Carburanti, Toil, Dilella Invest, and Giap, long-standing players in the Italian fuel distribution sector, collectively owned by six entrepreneurial families.

The transaction involves approximately 1,200 retail outlets, accounting for about 6% of the national network, distributed throughout Italy and including not only refueling stations but also ancillary roadside services, such as convenience stores and restaurants. The value of the transaction is set at €425 million.

The Consortium was assisted by Mediobanca and EQUITA Mid Cap Advisory as financial advisors.

Vega Carburanti was advised as financial advisor by the Mid Cap Advisory team of EQUITA, the Italian partner of Clairfield International.

EQUITA also acted as debt advisor for Vega Carburanti and Dilella Invest.

The legal aspects of the transaction were handled by Gianni & Origoni and Zaglio, Orizio e Associati, while EY-Parthenon handled the accounting activities and Pirola Pennuto Zei & Associati handled the tax aspects.

Agostino Apa and Enrico Zampedri, on behalf of the Consortium, said: “The acquisition of EG Italia brings a strategic asset such as the fuel distribution and roadside services network back under the control of private national operators. This is a unique transaction in the history of the sector, made possible by an industrial alliance capable of addressing new market challenges, with a particular focus on the evolution of services and the energy transition."